Filing Income tax in 2025

Tax laws and regulations can be complex and difficult to understand. Many individuals are unsure about their tax obligations, deductions, and credits. The fear of making mistakes on their tax returns or facing audits can create anxiety and fear.

Income Tax Slabs

| New Tax Regime Income 2025-26 | Slab Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 - ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

| Old Tax Regime | Slab Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 - ₹5,00,000 | 5% |

| ₹5,00,001 - ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

| - | - |

| - | - |

| - | - |

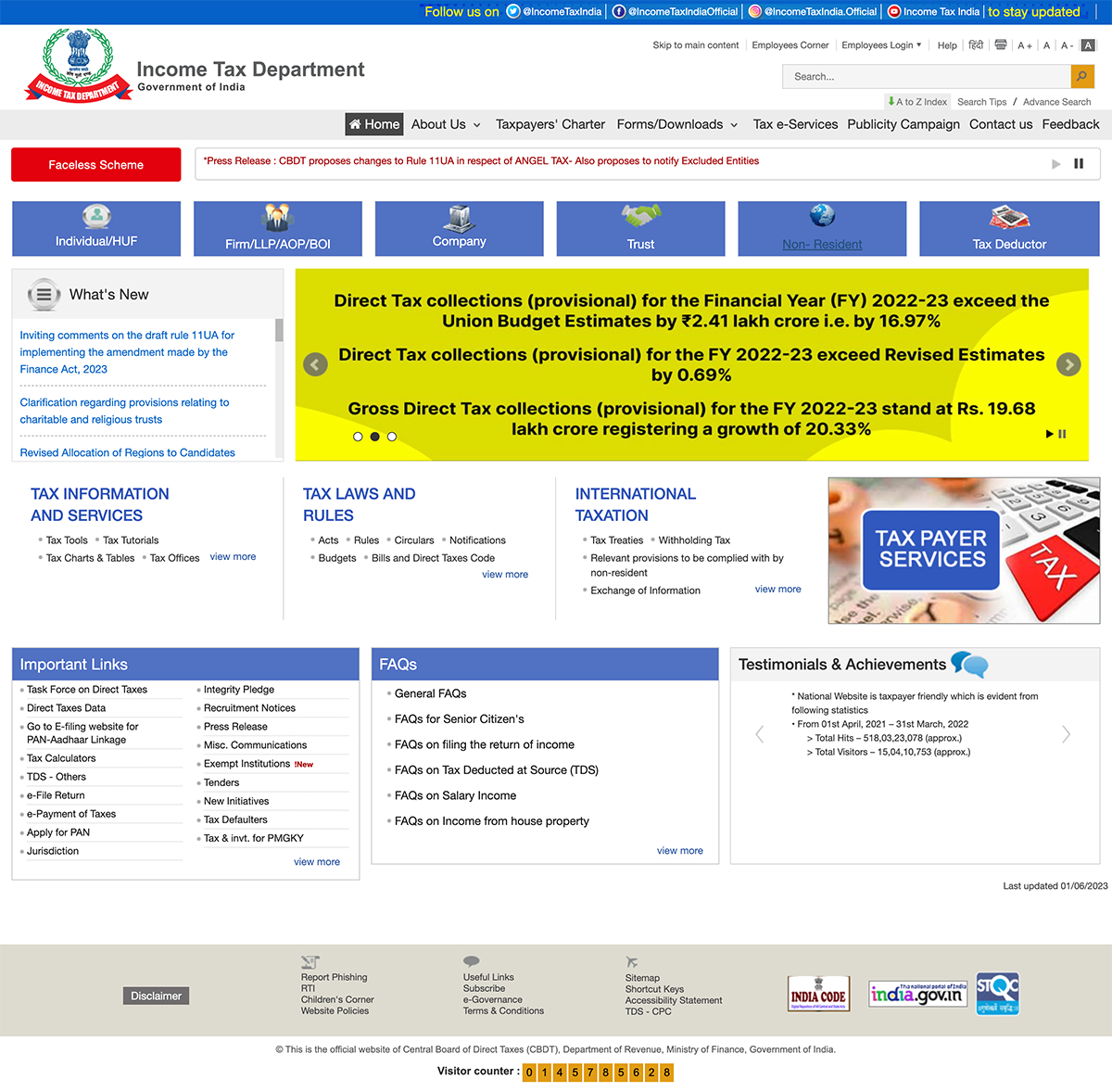

In India, income tax is levied on the income earned by individuals, companies, and other entities. The income tax rates and slabs are determined by the Finance Act, which is passed by the Indian Parliament every year.

New Regime

Income tax calculator

Old Regime

Income tax calculator

Delayed Your ITR Filing in 2025?

You have these three options now. Check where you stand.

Interest

In case you submit your tax return after the deadline, you'll be subject to interest charges at a rate of 1% per month or part thereof on the outstanding tax amount, as per Section 234A. Additionally, as per Section 234F, you'll be required to pay a late fee of Rs.5,000, which can be reduced to Rs.1,000 if your total income is below Rs.5 lakh.

Loss Adjustment

If you've suffered losses from investments in the stock market, mutual funds, properties, or any of your businesses, you can carry them forward and offset them against your income in the following year, resulting in a considerable reduction in your tax liability. However, to do so, you must report the losses in your ITR and submit it to the income tax department before the due date.

Belated Return

In the event that you fail to file your ITR by the due date, you may still file a return after the deadline, known as a belated return. However, you will be required to pay both the late fee and interest charges, and you will not be permitted to carry forward any losses for future adjustments. As for the current year, you may submit your belated return no later than December 31st, 2023.